Cancer Insurance

There is no such thing as a “good time” to get sick. According to the Canadian Cancer Society, 2 out of 5 Canadians are expected to develop cancer during their lifetimes. And the number of newly diagnosed cases of Cancer continues to increase rapidly each year. Cancer Insurance can protect your family when it matters most. Don’t make the mistake of waiting until its too late!!

Contact us today for your FREE No obligation Cancer Insurance Quote.

How we can Help:

- No medical exam, No blood test and limited medical questionnaire.

- 2 questions to qualify for $25,000 of Life Insurance.

- 2 additional questions for up to $100,000 of coverage.

- You will receive a lump sum payment upon a cancer diagnosis.

- You can use the money any way you like.

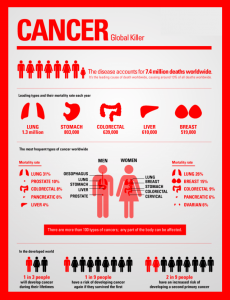

Diabetes and Cancer are two of the leading causes of death in Canada. Diabetes nearly doubles your risk of getting certain types of Cancer. That is a very high rate making protecting the ones you love even more important. The biggest mistake you can make is waiting to get Life Insurance. Complications from diabetes increase your premiums and limit your options. Let our professional team get you the Cancer Insurance coverage you need to protect the people who matter most.

The cost of a Cancer Diagnosis:

Cancer statistics are everywhere and can be overwhelming. However, Ignoring these facts can be financially devastating for you and your family. The cost of cancer can an incredibly large burden on any family. Protecting your loved ones before Cancer happens can be your smartest decision yet!!

- $17,729 is the average amount of lost wages you will face while battling Cancer.

- 25% is the percentage of income your loved ones will lose resulting from time off work to be with a loved one.

- 44% of patients use their savings and investments to replace the lost wages.

- 27% of patients take on more debt in the form of loans and credit cards.

- 26% of Cancer survivors return to work before they are ready due to financial reasons.

- $65,000 is the average cost of treatment with new Cancer drugs. Even if your plan covers 80%, your out of pocket expenses would be $13,000.

- 38 weeks is the average treatment period for many cancers. Employment Insurance Sickness benefits last 15 weeks and only covers 55% of your salary.

One rural family’s travel cost:

- 22 trips to Moncton = 11352 km’s

- 4 trips to Bathurst = 352 km’s

- Total = 11,704 km’s

- 11,704 km’s x 48.5 cents/km = $5676.44 (rate used by NB Government)

Parking:

- $8.00 x 44 days = $352.00

Accommodations:

- 25 nights at $11.00 per night = $275.00

- 1 night at a hotel = $150.00

- Total = $425.00

Food:

- 44 days x $50.00 per day = $2,200.00

Incidentals:

- 44 days x $20.00 per day = $880.00

Lost Wages:

- 44 days x $160.00 per day = $7,040.00